SUVs have overtaken station wagons, sedans and hatches as the go-to family car over the past decade, but are they really the better option?

Tesla disrupts new car sales figures: VFACTS March 2022

Tesla’s reputation as an automotive disruptor continues with the introduction of the electric vehicle marque into the official new car registration figures.

EV car maker Tesla has submitted data to the national new car sales and instantly shot to fifth place overall.

The Tesla Model 3 was also the top-selling passenger car in the country in March, according to VFACTS figures supplied by the Federal Chamber of Automotive Industries.

That’s a huge result and cements the brand as one of the major players in the market, rather than just the dominant EV car company.

But the headline number of 3,097 Model 3s for the month doesn’t tell the whole story. Tesla sold 4,417 vehicles for the first quarter of this year, largely because of the intermittent arrival of ships delivering cars from the company’s Shanghai factory.

That number puts Tesla into the top 15 cars sold so far this year. It also means the ongoing monthly tally will need to be averaged out to give an accurate indication of the company’s sales.

It’s still a massive achievement for a one-model company and the arrival of the Model Y SUV should spike those numbers, but there’s no official word on when the highly anticipated SUV will go on sale here.

Sales steady in 2022

The Australian market is still being choked by supply chain issues, based on the latest VFACTS data.

New car sales last month of 101,233 were up 1.2 per cent on 2021, but some of the major players were well down on sales, indicating they can’t get vehicles into the country to satisfy demand.

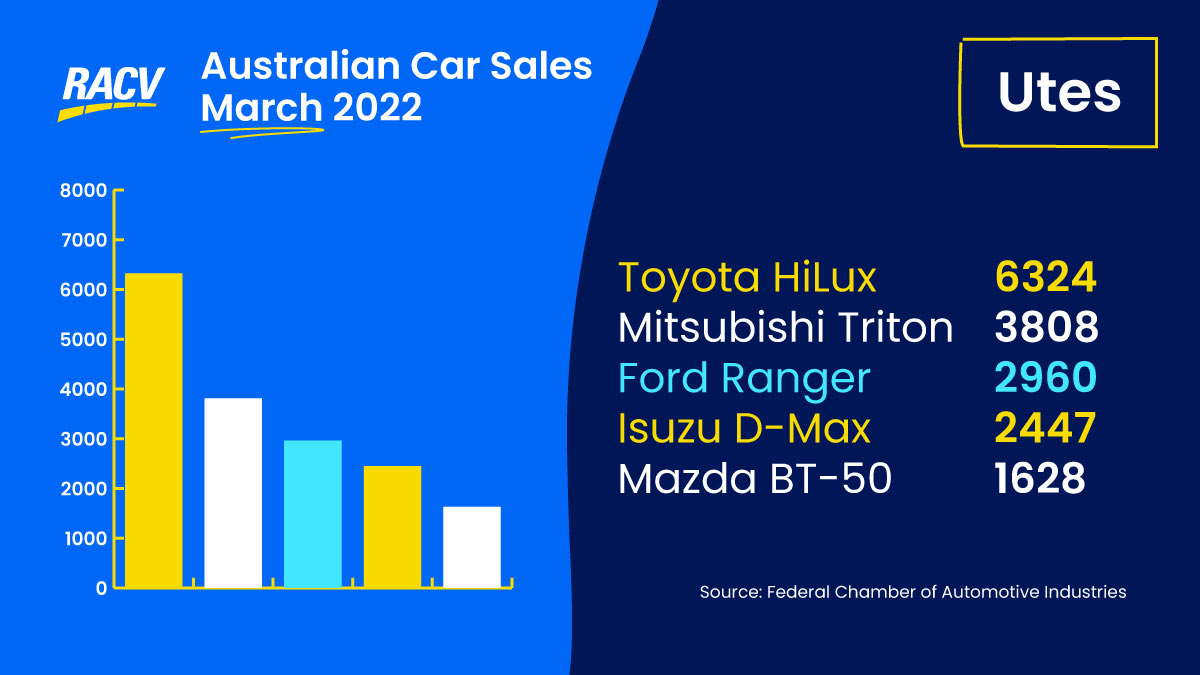

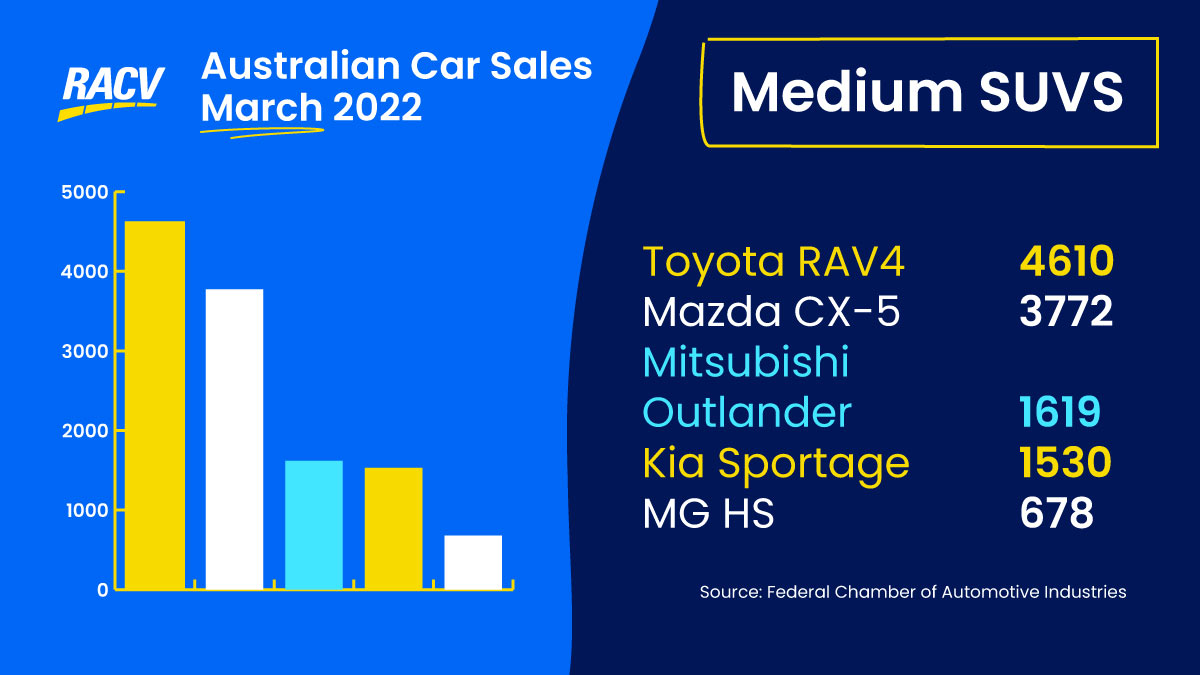

Toyota HiLux was again the best-selling vehicle with 6,324 sales, ahead of the Toyota RAV4 (4,610) and 3,808 registrations for the Mitsubishi Triton.

The face-lifted Mazda CX-5 finished fourth last month, while Tesla was officially fifth.

The Ford Ranger ute was down in an unaccustomed sixth spot as the former front-runner enters run-out mode ahead of the arrival of the next-generation vehicle in July or August.

Rounding out the top 10 was the Hyundai i30, Isuzu D-Max, Toyota Prado and Toyota Corolla.

Victorian sales defied the modest national increase to jump by 5.3 per cent in March with 27,155 vehicles sold.

Toyota still on top

Industry heavyweight Toyota continues its dominance of the local market. Sales of 21,828 were almost double the 11,248 registrations posted by second-placed Mazda.

Mitsubishi’s 9,007 sales put it in third place, ahead of siblings Hyundai and Kia, who are tussling over the fourth and fifth places with 6,516 and 6,051 sales respectively.

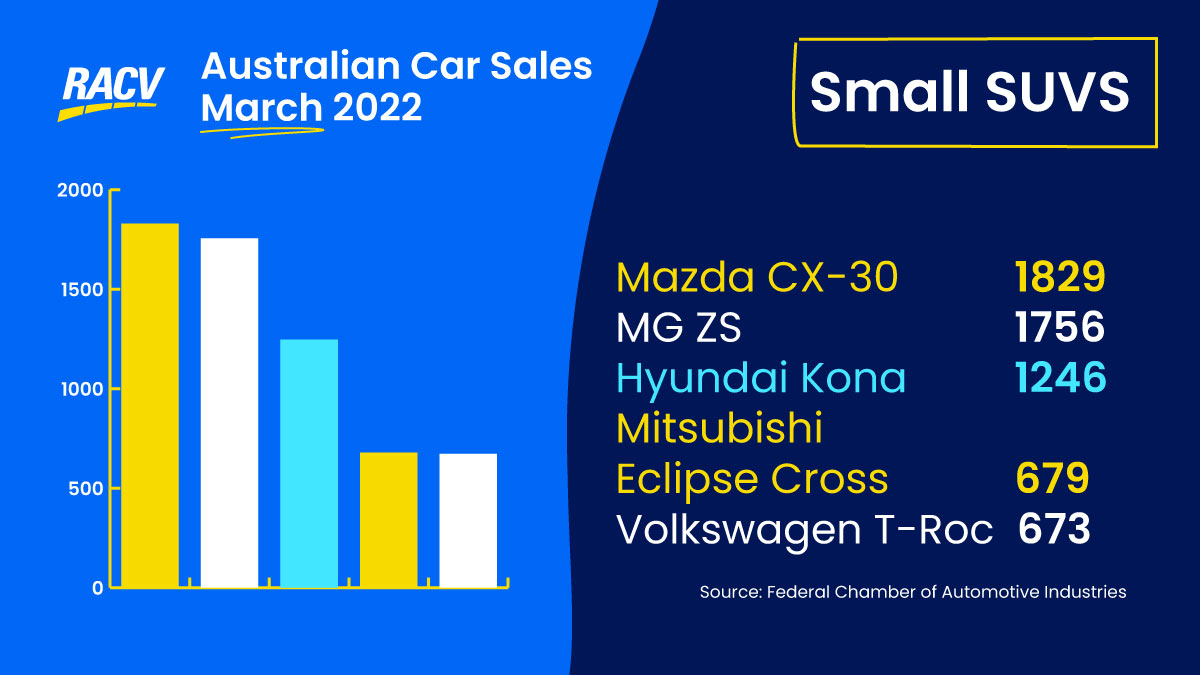

Sports utility vehicles continue to be the top-selling car type, with medium SUVs accounting for 18,512 sales in March; vehicles in the large segment posting 13,265 registrations and light SUVs posting 12,118 sales.

There were 17,995 new four-wheel-drive ute owners in March, along with 3,350 4x2 ute sales. Passenger cars were up on the same month last year at 21,999.

The Mitsubishi Triton was third in overall new vehicle sales in March, according to VFACTS figures

Supply handicaps deliveries

FCAI chief executive Tony Weber said the Australian market is facing a unique time “in which supply rather than demand is determining the size of the market” .

“This is due to manufacturers recovering from the pandemic-related shutdowns and the ongoing global shortage of micro-processing units.

“Consumer enquiries and demand for new cars remains strong. Manufacturers are working hard to match this demand with supply.”

Some of those manufacturers are struggling.

Industry heavyweight Nissan was down by more than 30 per cent for the month and year-to-date. First quarter sales of 8,322 vehicles fell by more than 3,800 units on the same time in 2021, largely due to the lack of Nissan X-Trails, with 2,600 fewer sales year-on-year.

Honda’s woes continue with a year-on-year slump of 2,600 vehicles. Civic sales alone are down 1200 vehicles.

Mercedes-Benz is similarly suffering. Sales are down by almost 27 per cent, or 2,100 vehicles, in the first three months of this year, led by the absence of A-Class and C-Class stock in showrooms and a drop in G and GLE wagon supply.

The drought of cars is affecting all the mainstream brands in the Volkswagen Group.

Audi sales in the first three months of this year are down almost 1,700 cars, or more than 38 per cent, over 2021; Skoda sales are down by 1,300 vehicles (almost 47 per cent) and VW itself down by 32.6 per cent or 2,900 registrations.

Porsche has defied the trend. Its 1576 sales are up 15.3 per cent from the first three months of 2021.

Bucking the trend

Some car makers have managed to maintain supply and make decent inroads into the market over the first three quarters of this year.

Mitsubishi is the headline act. It has registered 23,253 vehicles so far in 2022, a 6,500-unit jump over the same period in 2021.

MG posted first quarter sales of 11,267, a 29 per cent jump on last year.

Renault is enjoying a sales renaissance. Q1 sales of 2,545 vehicles is almost double the company’s 2021 achievement in Australia.

The information provided is general advice only. Before making any decisions please consider your own circumstances and the Product Disclosure Statement and Target Market Determinations. For copies, visit racv.com.au. As distributor, RACV Insurance Services Pty Ltd AFS Licence No. 230039 receives commission for each policy sold or renewed. Product(s) issued by Insurance Manufacturers of Australia ABN 93 004 208 084 AFS Licence No. 227678.